Ever heard of a cool way to invest in houses and buildings without needing a big bag of money? It’s called real estate crowdfunding — and it’s changing the game. This is all about letting regular folks, like you and me, team up online to invest in real estate together. But, you might be thinking why it is important when other choices exist, right?

Well, that’s why we’ve created this guide for you. In this article, we’re going to talk about why this is a big deal. And we’ll let you know how it works, why it matters, and what you should know if you’re curious about getting in on the action.

So, why wait? Scroll down and learn everything.

The Rise of Crowdfunding

Mark Valderrama, CEO & Founder of Aquarium Store Depot, explains really, “Crowdfunding is like a team effort for money. Instead of one person or a big company putting up all the cash, it’s a bunch of regular folks, each contributing a little bit.”

Still not sure? Let me share an example.

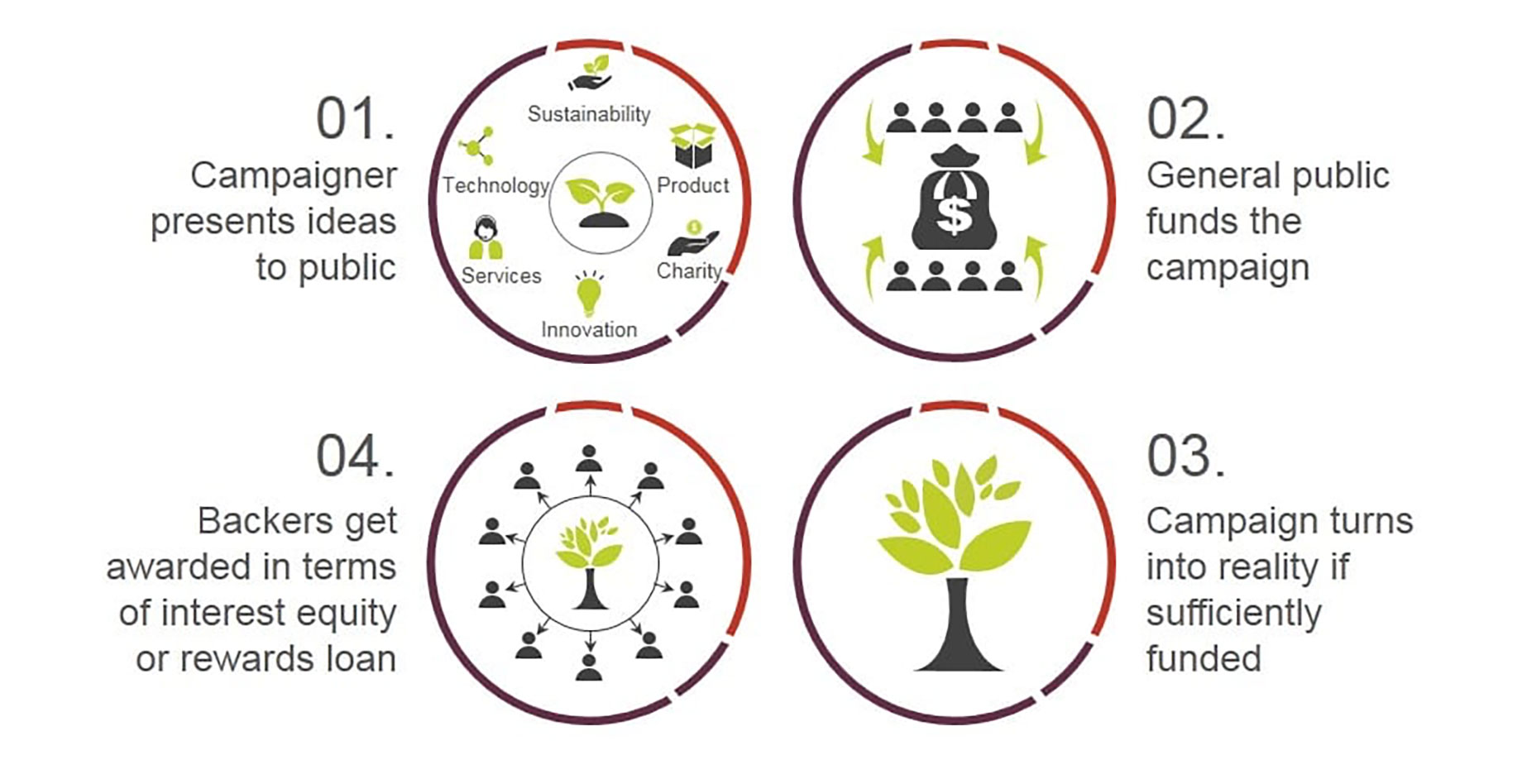

For example, you have a project, like creating a new gadget, making a movie, or even starting a charity. Now, instead of going to a big bank or a rich person for money, you can ask lots of regular people, or “crowd,” to each give a little bit. When lots of people do this, you can collect enough money to get your project off the ground.

So, we hope you get the point. Now, let’s talk about the evolution of crowdfunding in various industries.

Evolution:

Crowdfunding didn’t start with real estate — it began in other areas like arts, technology, and charity. People saw how great it was to join forces to make awesome things happen. Over time, crowdfunding platforms (websites that help organize this kind of funding) started popping up for all sorts of projects.

Now, let’s talk about real estate crowdfunding.

What is Real Estate Crowdfunding?

Real estate crowdfunding is a modern way for people to invest in properties collectively. Instead of needing a huge amount of money to buy a whole property, individuals can contribute smaller amounts through online platforms. These platforms pool together funds from many investors to purchase, develop, or manage real estate assets like houses, apartments, or commercial buildings.

How does it work?

Real estate crowdfunding starts with property owners or developers listing their projects on crowdfunding platforms. Investors, both individual and institutional, browse these listings and contribute funds to the projects they’re interested in. Once enough funds are raised, the crowdfunding platform manages the investment, which can include buying a property, developing it, or funding a real estate project.

Now, have a quick look at the role of crowdfunding platforms.

Crowdfunding Platforms:

Crowdfunding platforms act as intermediaries that bring together investors and real estate opportunities. They provide a marketplace for property listings, facilitate the collection of funds, and often offer due diligence, legal, and management services. These platforms aim to make the investment process seamless and secure — ensuring that investors can easily participate in real estate ventures without the complexities of direct property ownership.

Here are some of the most popular real estate crowdfunding platforms:

1. RealtyMogul

RealtyMogul is a well-established real estate crowdfunding platform that offers both debt and equity investment opportunities. They provide access to a diverse range of commercial real estate projects, including office buildings, apartment complexes, and retail spaces. RealtyMogul is known for its stringent due diligence process and its commitment to transparency. Investors can start with a relatively low minimum investment — making it accessible to a wide range of individuals.

2. Fundrise

Fundrise is a popular platform that specializes in providing access to a diversified portfolio of real estate assets. They offer eREITs (electronic Real Estate Investment Trusts) and eFunds, which allow investors to spread their investments across various real estate projects. Fundrise offers low fees and aims to provide long-term, passive income to its investors. It’s also known for its user-friendly interface and transparency in presenting projected returns and risks.

3. CrowdStreet

CrowdStreet helps people with money who want to invest in buildings and land. They introduce these investors to many different companies that build or own property all over the United States. What makes CrowdStreet special is that they have a website where investors can pick the exact project they want to invest in. They give lots of information about each project, and sometimes they have online classes and meetings to teach investors more about what they can invest in.

Models of Real Estate Crowdfunding:

Basically, there are three different models of real estate crowdfunding. So, let’s take a look at each of them:

1. Equity-based crowdfunding

Equity-based real estate crowdfunding offers investors an opportunity to delve into the property market without the need for substantial capital. By purchasing a fraction of ownership in a property, investors become stakeholders, reaping the benefits of both rental income and potential appreciation in property value. As Martin Seeley, CEO of Mattress Next Day remarked, “Equity crowdfunding democratizes real estate investment, turning everyday individuals into property stakeholders and allowing them to ride the waves of the market.”

2. Debt-based crowdfunding

Debt-based crowdfunding shifts the investor’s role from an owner to a lender. By providing loans to property developers or owners, investors secure a position where they can expect regular interest payments, making it a more predictable and steady source of income. Andrew Priobrazhenskyi, CEO and Director at DiscountReactor states, “Debt-based crowdfunding is akin to planting a seed and watching it grow steadily, knowing when and how much fruit it will bear.”

3. Hybrid models

Blending the best of both equity and debt-based crowdfunding, hybrid models offer a diversified approach to real estate investment. Investors can enjoy the dual benefits of owning a piece of the property while also earning interest on a loan. Johnny Dixon, Marketing Director at Accountant Edinburgh, observes, “Hybrid crowdfunding models are the symphony of real estate investment, harmonizing the melodies of ownership and lending to create a balanced investment portfolio.”

Remember that real estate crowdfunding is subject to various legal and regulatory requirements that vary by country and region. It’s important for both investors and platforms to comply with these regulations to ensure a safe and transparent investment environment.

So, let’s have a look at the benefits of real estate crowdfunding.

Benefits of Real Estate Crowdfunding:

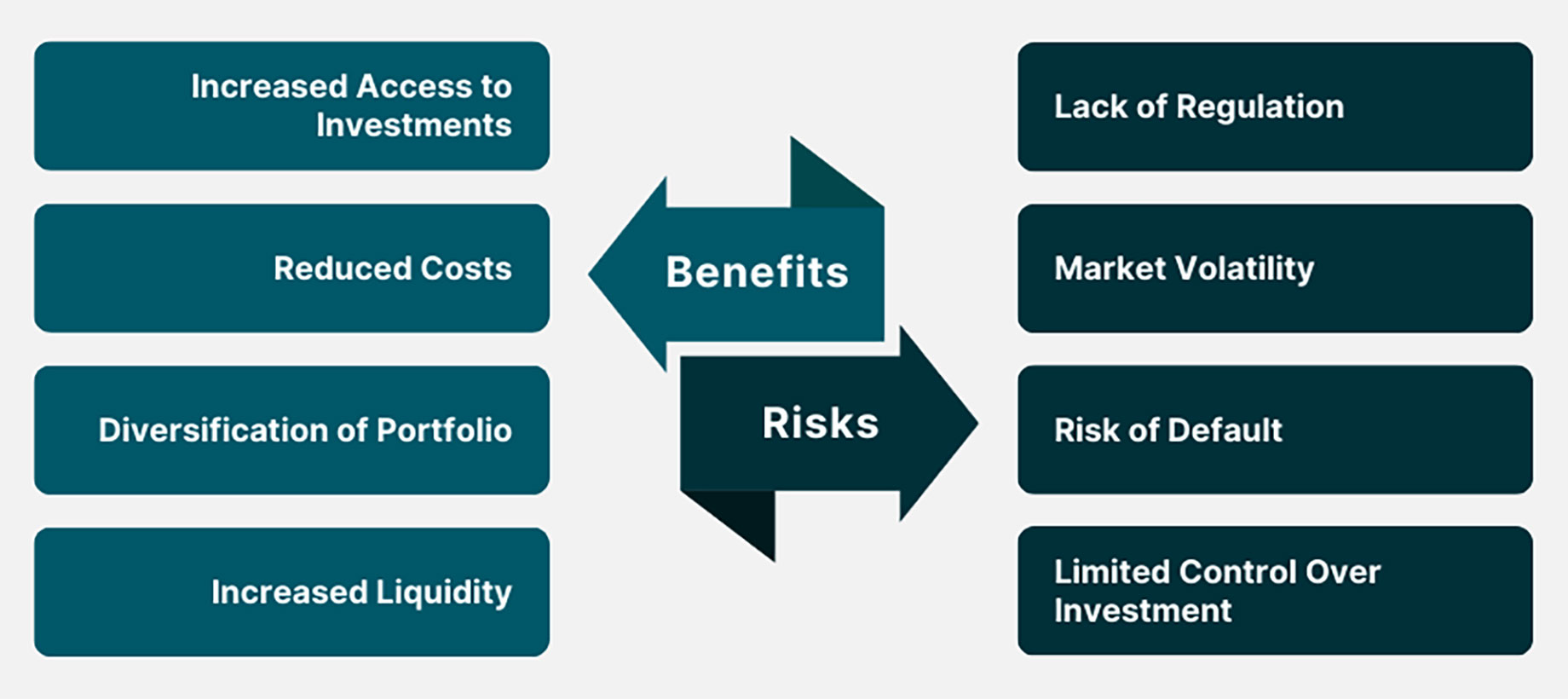

Real estate crowdfunding brings a lot of benefits. Here are some:

Increase Accessibility

Real estate crowdfunding has revolutionized the way individuals approach property investment. By allowing investments with smaller sums, it has opened the doors of real estate to many who previously found it out of reach. As Tiffy Cu, Travel Blogger at Asiatravelbug, aptly puts it, “Real estate crowdfunding has leveled the playing field, turning the dream of property investment into a reality for many.”

Diversification and Risk Mitigation

One of the significant advantages of real estate crowdfunding is the ability to spread investments across various projects. This diversification acts as a safety net, cushioning investors from the volatility of individual property markets. Sam McKay, CEO of Enterprise DNA, observes, “Diversification in real estate crowdfunding is like having multiple anchors; even if one fails, the others ensure you don’t drift away.”

Potential for Passive Income

The allure of earning without active involvement is a significant draw for many investors. Real estate crowdfunding offers this passive income potential, allowing investors to reap the benefits of property ownership without the day-to-day hassles. Khashayar Shahnazari, Chief Executive Officer at FinlyWealth, notes, “With real estate crowdfunding, you’re not just buying property; you’re buying time and peace of mind.”

Professional Expertise

Real estate crowdfunding platforms often bring together a team of seasoned professionals who oversee property selection and management. This collective expertise ensures that investments are not just based on intuition but on informed decisions. As Dan Close, Founder, and CEO at Local Cash Home Buyer, remarks, “In the world of real estate crowdfunding, you’re not just investing in properties; you’re investing in the collective wisdom of industry experts.”

Lower Entry Barriers

The traditional barriers that deterred many from real estate investment are being dismantled by crowdfunding. With its lower minimums and user-friendly approach, it’s becoming a go-to for many budding investors. Laura Capon, Lead Researcher & Gardener at Price My Garden, states, “Real estate crowdfunding has turned the intimidating gates of property investment into welcoming doors.”

Speed

In the fast-paced world of investments, time is of the essence. Real estate crowdfunding, with its streamlined processes, ensures that investors can jump into opportunities without the lengthy waits of traditional property transactions. As Christine Evans, Sr. Director, Marketing Communications at FICTIV points out, “In the race of real estate, crowdfunding is the sprinter, reaching investment finish lines in record time.”

Challenges and Risks:

Real estate crowdfunding does not always stay profitable; sometimes you may encounter some challenges and risks. Here are some of the challenges and risks you need to be aware of:

- Market and Economic Risks: Real estate markets can be sensitive to economic conditions. Economic downturns or local market fluctuations can affect property values and rental income — impacting investor returns.

- Liquidity and Exit Challenges: Unlike stocks or bonds, real estate investments can be less liquid. Selling a real estate investment may take time, and there’s no guarantee of finding a buyer quickly. Investors should be prepared for potential delays in accessing their funds.

- Regulatory Risks and Compliance: The regulatory environment for crowdfunding can change and may differ by location. Compliance with legal requirements is crucial for both platforms and investors. Changes in regulations can impact how investments are structured and managed.

- Due Diligence and Fraud Concerns: Investors need to conduct thorough due diligence on both the crowdfunding platform and the real estate opportunities listed. Scams and fraudulent platforms can exist. Ensuring that the platform is reputable and that the investment details are transparent and verifiable is essential to mitigate fraud risks.

10 Pro Tips for Real Estate Crowdfunding Investors:

Investing in real estate crowdfunding can be an exciting way to diversify your portfolio and potentially earn income from property investments. But, like any investment, it comes with its own set of considerations and risks. To help you navigate this burgeoning field successfully, here are some of the best tips for real estate crowdfunding investors.

1. Understand Your Investment Goals

Before going into real estate crowdfunding, clarify your investment objectives. Are you seeking regular rental income, long-term appreciation, or a mix of both? Knowing your goals will help you select the right projects on crowdfunding platforms that align with your financial strategy.

2. Research Crowdfunding Platforms

Not all crowdfunding platforms are created equal. Take time to research and compare different platforms. Consider factors such as fees, track record, investor protections, and the types of real estate opportunities they offer. Choose a platform with a solid reputation and transparent operations.

3. Diversify Your Investments

Spread your investments across multiple projects or properties. Diversification helps mitigate risk. If one investment underperforms, gains from others may offset the losses. Diversification can also provide exposure to various property types and locations — further reducing risk.

4. Conduct Due Diligence

Thoroughly examine each investment opportunity. Review the property details, financial projections, and the track record of the property developer or owner. Assess factors like location, demand, and market conditions. Don’t hesitate to ask questions and seek clarification from the platform or project sponsors.

5. Assess the Risk-Return Profile

Understand the risk associated with each investment. Equity-based investments typically carry higher risk but offer the potential for significant returns. Debt-based investments tend to be less risky but may yield lower returns. Balance your portfolio based on your risk tolerance and financial goals.

6. Stay Informed about Market Trends

Keep yourself informed about real estate market trends and economic conditions. Changes in the broader economy or local markets can impact property values and rental income. Staying informed will help you make informed investment decisions.

7. Monitor Your Investments

Once you’ve invested in projects, stay engaged and monitor their progress. Keep an eye on rental income, property management, and any updates provided by the crowdfunding platform. Regular monitoring allows you to address issues promptly.

8. Seek Professional Advice

If you’re new to real estate investing or uncertain about certain aspects, consider seeking advice from financial advisors, real estate professionals, or legal experts. Their expertise can help you navigate complex decisions and avoid potential pitfalls.

9. Be Patient

Real estate crowdfunding investments may not provide immediate returns. Property projects take time to develop, and rental income can vary. Exercise patience and avoid making hasty decisions based on short-term fluctuations.

10. Review Legal and Regulatory Requirements

The last and the most important tip. Real estate crowdfunding is subject to legal and regulatory oversight, which can vary by jurisdiction. Ensure you understand the legal framework governing your investments. Compliance with regulations is important to protect your investments and rights as an investor.

Conclusion

Real estate crowdfunding is transforming the way people invest in properties. It breaks down barriers — making property investments accessible to a wider audience. By understanding your goals, conducting due diligence, and diversifying your investments, you can navigate this exciting field successfully. Real estate crowdfunding offers opportunities for both income and growth, but like any investment, it comes with risks. With the right knowledge and approach, you can harness its potential and work towards your financial goals.