Real estate comparable sales are recent closed sales of homes that are similar to the subject property. It’s important that they are in a similar area, have similar size, bedrooms, baths, and square footage. Comps are the closest thing we have to determining the value of a home. As a licensed Realtor, here is what I like about real estate comparable sales: they show what buyers are willing to pay, they are not based on what the seller thinks their property is worth, and they help with tough conversations about pricing. And here is what they are not: they don’t care how much money the homeowner has invested in the house, they cannot predict emotional purchases, and they are not a lender’s appraisal.

CMA vs. Appraisal: What’s the Difference

This is where homeowners get confused. A CMA is what agents analyze to help homeowners choose a listing price. It is built on real estate comparable sales, plus local expertise and what buyers are paying in the current market. An appraisal is what the lender mandates to support the loan. It also uses comparable sales, but with a different goal, to protect the bank’s money. A quick translation: CMA: What price gives the homeowner the best opportunity at strong offers. Appraisal: Does the contract price support a value for the loan. Both are important but can be wildly different. A Comparative Market Analysis can use more data and looser criteria. Appraisals are typically more standardized and are limited on the data they can use.

How to Find Real Estate Comparable Sales Comps

If you’re looking to pull comps on a property, follow these guidelines:

Step 1: Property Information

Start by writing down what you are actually comparing. That includes the property type (single family, condo, or townhouse), beds, baths, and square footage. Then note year built, lot size, garage, basement, finishes, major updates, and condition. Condition matters here, and you have to be honest about it.

Step 2: Define the Area

Location is the most important thing in good real estate comparable sales analysis. Start in a micro market and adjust if the neighborhood has lower sales volume. A radius of about a quarter mile to a half mile works in smaller neighborhoods. A timeframe of no more than 6 months is a good standard. Property type should match exactly or very close. Sometimes you must widen the criteria. A one mile radius can be reasonable in most areas. A one mile radius can also cross natural occurring borders. That is why local knowledge about areas, schools and geography still matter.

Step 3: Evaluate Five to Seven Strong Comps

You do not need twenty five. A handful of good comparable sales should be sufficient. When I do an analysis I try to at least find five of the best match sold homes, plus one or two similar matched homes to support the range. Active listings and pending sales should also be analyzed.

Step 4: Digging Deeper Into Each Sale

This is what the online home value estimators can’t tell you. Comparables can look perfect on paper and still be a poor data point because of terms, condition, or unknown circumstances. Online estimators don’t know if the house hasn’t been updated in 50 years, or if it smells like cat pee. They also don’t know if you just did a $100,000 kitchen renovation. They strictly rely on public data. When I review real estate comparable sales, I look for whether it was a normal arms length sale, if there were seller concessions, what the condition was, whether it was updated, and whether it sold quickly or sat on the market with price reductions. All are important information a good agent needs to know when doing an evaluation.

Comparable Sale Checklist

Before doing a comp analysis, check it against this checklist: same property type as the subject, similar square footage, similar bed and bath count, similar year built and layout style, similar condition and upgrade level, a recent sale (not something from a different market era), and the same neighborhood or micro market, not just “nearby.”

The Right Comp Checklist for Real Estate Comparable Sales

When evaluating the best real estate comparable sales, look for the same neighborhood or the closest pocket that buyers see as equivalent, similar days on market and showing activity, similar finishes and condition (not just similar square footage), and outliers based on price per square foot. Good comparables will stand out and not have to be forced.

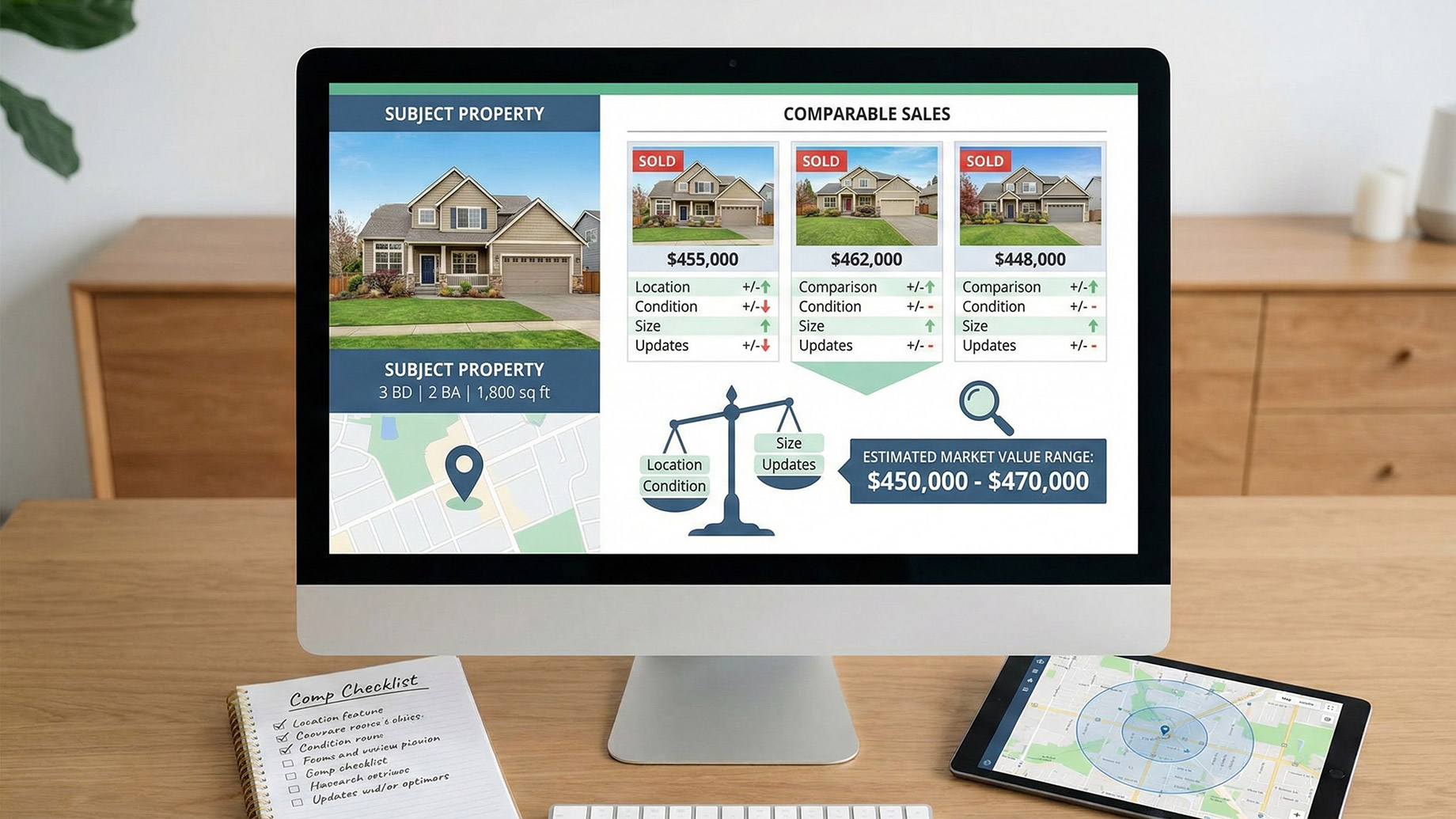

Adjusting Comparable Values

This is where real estate comparable sales either become powerful or get abused. Most properties are never identical, so adjustments to value have to be made. Here are the guidelines: if the comp is better than the subject, subtract value from the comp. If the comp is worse, add value to the comp. It’s pretty straightforward. The difficult part is assigning value to the differences. The adjustments that usually matter most include condition and quality of updates, bathroom count and functional layout, usable square footage (not just total), above grade vs below grade square footage, garage/basement finish/outdoor features, and location issues like busy roads, backing to commercial, or other things that effect value. Price per square foot should be used as a starting point. It’s most useful in newer construction but becomes less important as homes age. Condition is the largest driver of value in homes right behind location. Homes that are in move in condition or that have been updated with todays current trends will always sell at a higher price per square foot.

Common Mistakes When Doing an Analysis

Running comparable sales is not an exact science. Here are some common mistakes I see agents make: using active listings as a guideline instead of closed sales, mixing property types like comparing a ranch to a two story home, using sales from a different micro market, not putting enough weight into the condition, and cherry picking only the highest sales. Homeowners sometimes see things with rose colored glasses on. This is normal, they live in the home. They only see the positives and you stop noticing the deferred maintenance. Buyers are just the opposite, they notice everything.

When Homeowners Need to Sell Fast

Sometimes a analysis will deliver a message homeowners do not want to hear. The top sales in a neighborhood are updated, clean, and move in ready. Meanwhile the house you are analyzing might need a roof, a kitchen, or maybe just hasn’t been touched since the 1950’s. Or maybe the family inherited the home, live out of state, and the idea of updating and making repairs doesn’t make sense. For properties like these, homeowners still have choices. They can list it and price it according to the comps, knowing the condition will limit the buyer pool. They can list it as-is and see what happens. Or skip the retail listing process and talk with a we buy houses company that purchases homes as is for cash. For some sellers, that last option is the difference between months of uncertainty and a clean, predictable closing. A reputable cash home buyer makes sense when speed matters more than getting top value.

The Data Never Lies

Real estate comparable sales are your best avenue to a fair market price because they show what buyers have actually paid for homes, not what a homeowner hopes to sell for. Keep the area used to find comps tight, adjust heavily for condition, and don’t let outliers cloud your judgement on market value. By using solid comparable sales, you avoid the property sitting on the market, cutting the price, and chasing the market down. Pricing a home correctly from the start will always help a homeowner get the best possible value.