While being a dog owner often brings joy and companionship, it also brings responsibility.

While most interactions between dogs and people are positive, there are times when an unexpected bite can lead to serious consequences. For homeowners, these incidents can quickly raise questions about liability and how insurance coverage applies.

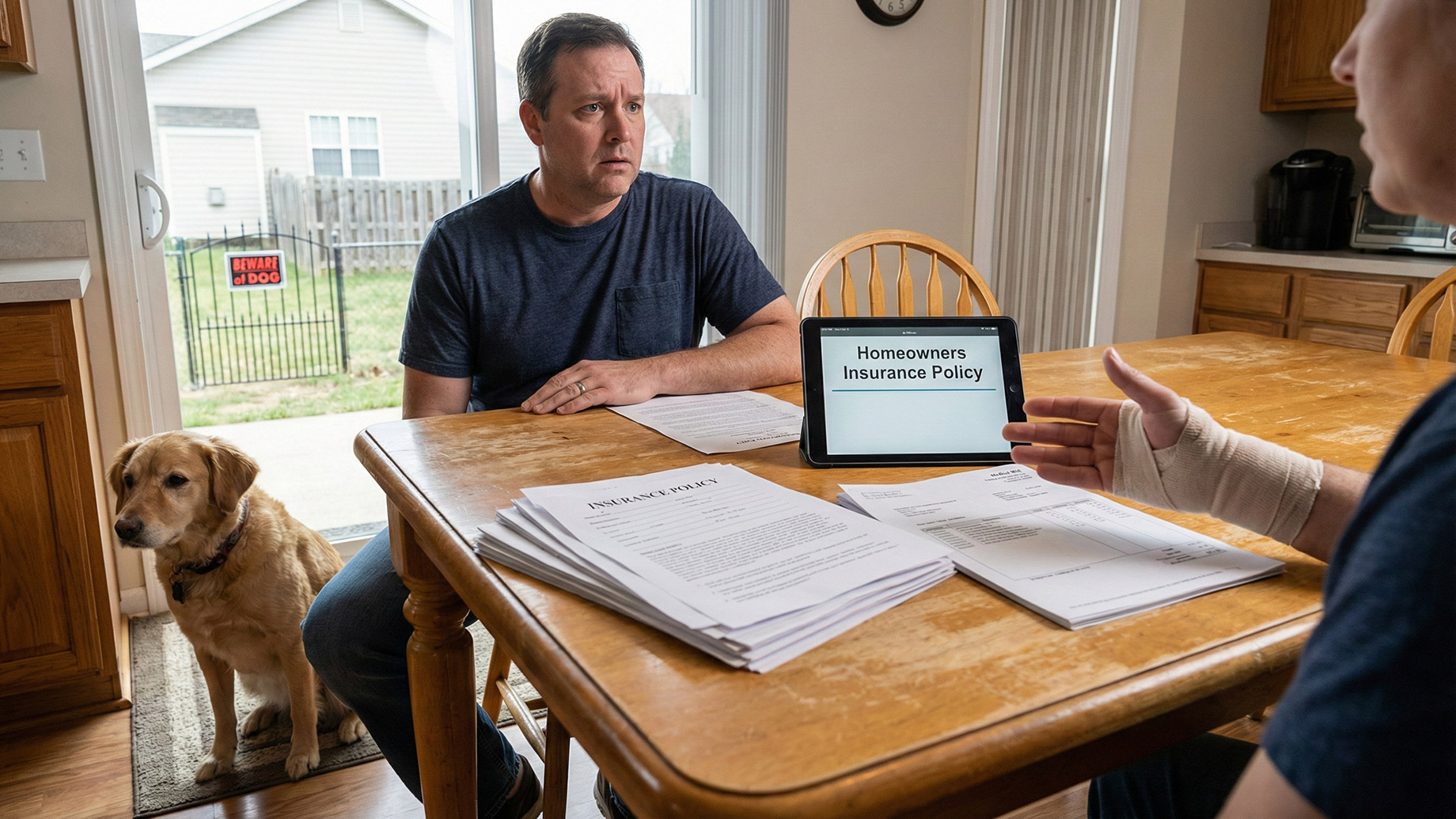

It’s important to know how your homeowners’ insurance handles dog bites, as it can help protect both pet owners and those injured. Insurance policies are confusing and filled with legalese, though, making it difficult to fully understand what a policy may or may not cover. This is why it is critical to work closely with a law firm that handles complex dog bites.

Why Dog Bite Claims Are Common

Dog bites happen more frequently than many realize. Millions of people are bitten by dogs every year, and a significant percentage of these injuries require medical attention. Because medical bills can add up quickly, victims often look for compensation.

When the bite occurs at a residence, the dog owner’s homeowners’ insurance policy often becomes the focus of the claim.

How Coverage Typically Works

Typical homeowners’ insurance policies include liability coverage. This coverage is designed to protect the homeowner financially if their dog injures someone. The policy generally pays for medical expenses, lost wages, and even legal defense costs if the claim leads to a lawsuit.

However, the extent of your coverage can vary depending on the policy terms and state laws.

In some cases, policies have liability limits. For example, a policy may cover up to $100,000 or $300,000 in damages. If the costs exceed that amount, you could personally be responsible for the remaining expenses.

It’s important to understand these limits because dog bite claims can involve significant financial risk.

Breed Restrictions and Exclusions

One aspect that surprises many dog owners is that not all policies treat dogs equally. Some insurance companies have restrictions on certain breeds they consider high risk. Breeds like pit bulls, Rottweilers, or Dobermans are sometimes excluded from coverage altogether.

Other policies may cover all breeds but exclude dogs with a history of aggression. If a dog has previously bitten someone, the insurer might deny coverage for any future incidents.

These types of exclusions make it important that you carefully review your policy and ask your insurer about any breed-related restrictions.

What Homeowners Should Do After a Bite

If your dog bites someone, quick action matters. Both the injured person’s well-being and your legal protection could depend on it. As a homeowner, you must take steps to get any victims proper medical care, document the event, and notify your insurance company.

Key actions include:

- Provide immediate medical assistance to the injured person.

- Exchange contact information with the victim.

- Take photos of the scene as well as any visible injuries.

- Report the incident to your insurance company as soon as possible.

- Avoid making statements that admit fault before the situation is reviewed.

By acting quickly and responsibly, homeowners show that they take the incident seriously and reduce the risk of complications later.

Liability and Medical Payments Coverage

Homeowners’ policies often include two different types of coverage that can apply in dog bite cases.

Liability coverage addresses the broader damages, such as lawsuits or lost wages. Medical payments coverage, on the other hand, is a smaller benefit designed to cover immediate medical costs without requiring proof of fault.

Coverage for medical costs typically ranges from $1,000 to $5,000. It can help cover emergency room visits or initial doctor’s appointments. While this doesn’t replace liability insurance, it does provide quick assistance and may help to prevent disputes from escalating into larger claims.

Legal Considerations That Can Affect Claims

The way homeowners’ insurance responds to dog bite claims can also depend on state law. Some states follow strict liability rules, meaning a dog owner is responsible for a bite regardless of whether the dog showed aggression before.

Other states follow a “one bite” rule, which may give owners more protection if the dog has no history of aggression.

These legal frameworks influence how insurers assess dog bite claims and whether they pursue settlement or litigation strategies. As the homeowner, you should be aware of your state’s dog bite laws as well, to better understand your potential exposure to risk.

Preventing Dog Bite Incidents

The best way to avoid a stressful insurance claim is to prevent bites from happening. Responsible pet ownership and proactive safety measures go a long way. Dog owners can take steps such as training, socialization, and securing their pets in appropriate environments.

Preventive strategies may include:

- Enrolling dogs in obedience training.

- Supervising interactions between dogs and unfamiliar people, especially children.

- Using fences, leashes, or gates to control the dog’s environment.

- Keeping vaccinations and vet visits up to date.

- Learning to recognize signs of stress or agitation in your dog.

Not only do these measures reduce the risk of injury, but they also demonstrate responsibility if an incident occurs.

Why Policy Review Is Important

Because coverage varies so widely, homeowners should review their insurance policies regularly.

This is particularly important for new dog owners or those who have changed circumstances, such as adopting a different breed or moving to a new home. If your insurer excludes coverage for your dog, you may want to explore additional options, such as a pet liability policy.

Checking your coverage before an incident happens can help you avoid unpleasant surprises. It also ensures that you have proper protection in place for your household and visitors. Dog ownership brings responsibilities that extend beyond daily care. If a bite occurs, homeowners’ insurance often serves as the financial safety net, covering medical costs, legal fees, and other damages.

Unfortunately, this coverage isn’t automatic or universal. Breed restrictions, liability limits, and state laws can all affect how claims are handled.

By understanding your policy, taking preventive measures, and responding appropriately if an incident occurs, you can better protect yourself and your dog. In the end, preparation not only helps reduce financial risk but also ensures a safer environment for everyone.