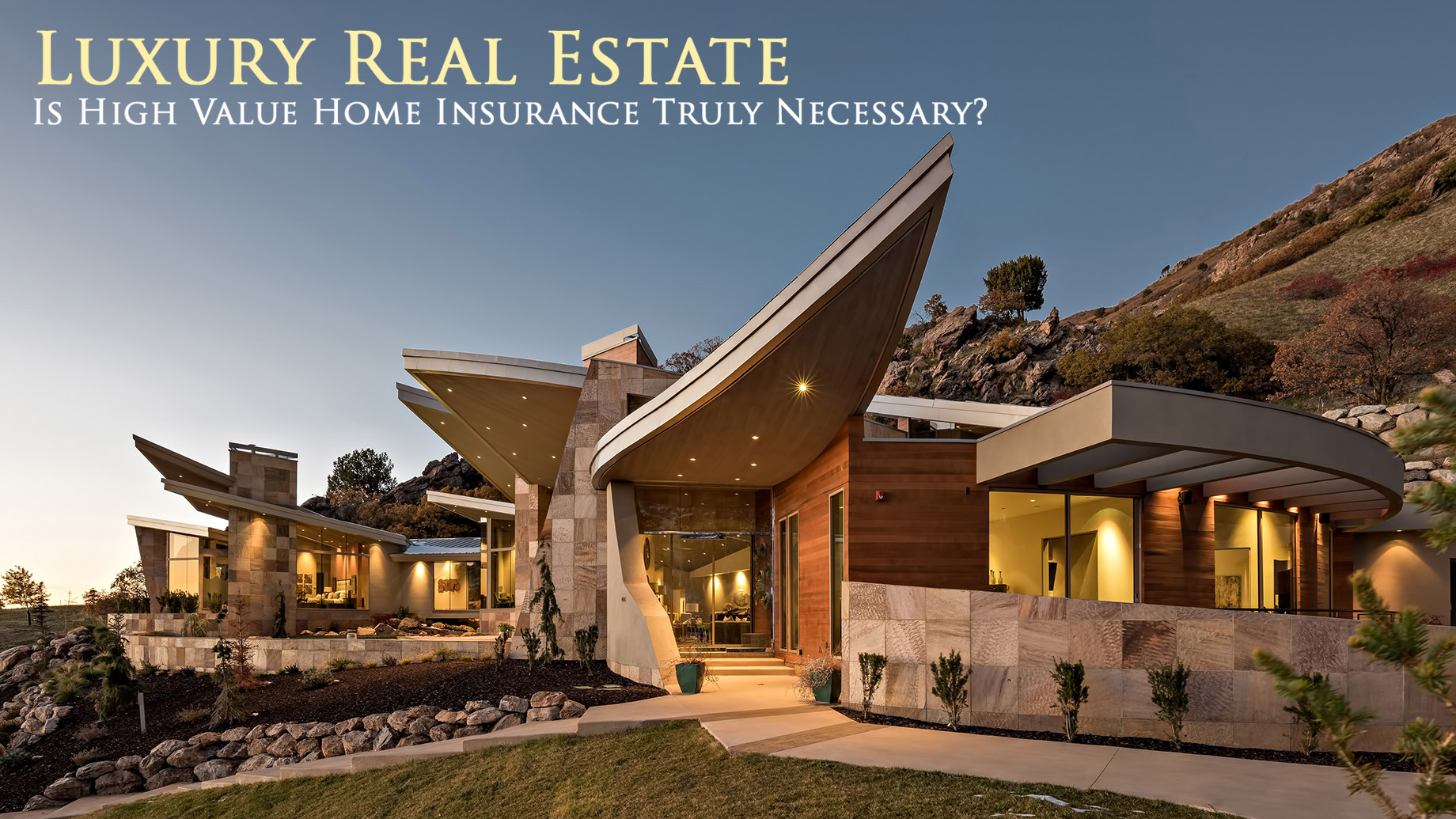

Home insurance is an extremely important aspect of home ownership. There’s no doubt about that. Every home should have it, and there are no exceptions to that. However, not all homes have the same value. We have mansions, high-value homes overlooking hills, and other homes that are custom-built. Not only that, but one can also assume that these luxury homes also contain high-value items within.

And in the same manner that these homes are specially built, the insurance policies that protect these homes should also be specially made.

But the problem is that about 40% of all high-value homes are actually under-insured, and this is where these homeowners run into some major problems. This is why only the best rated house insurance companiesactually get to handle these types of homes. So, here’s the twist:

High-value homes need high-value home insurance policies. That is an indisputable fact in itself.

Why? Read on below and find out:

High-Value Homes Are Significantly More Expensive To Rebuild

As previously surmised, about 40% of luxury homes are significantly under-insured. This is because the actual value of the house is less than the cost of rebuilding it. A common mistake that homeowners make when it comes to home insurance is that they base the insurance policy on the home value, not on the cost of rebuilding the home.

Luxury homes require luxury materials. Not only that, but a custom construction also requires special craftsmanship, and these often come at a high cost. So, if an ordinary home is under-insured when its policy is based on its actual value, the degree to which this applies to luxury homes is greatly amplified.

Some high-value homes may also come in the form of heritage homes, which are older and may require specially-sourced materials to rebuild. Whichever is the case, high-value homes are expensive to rebuild.

High-Value Home Insurance Policies Have Higher Coverage Limits

High-value home insurance policies cover damages from $1,000,000 up to $50,000,000. This makes sense given the value of the homes that you’re going to be dealing with, after all.

Higher Personal Effects Coverage

Luxury homes contain luxury items. There’s no doubt about that. So, it also makes sense that the coverage for these personal effects would also be significantly higher than what would be covered in an ordinary home owner insurance policy. A high-value home insurance policy typically covers up to 70% of all personal effects.

In and Out Servant Coverage

Given the size of luxury homes, it’s not unthinkable that these homes may also require a bigger home maintenance staff to keep it functional and clean. Ordinary homes do not need this type of coverage as the typical home usually only needs one maid or none at all. Conversely, luxury homes require a sizeable staff in order to maintain the house. Accidents happen. That’s an ugly thought, but it’s also the truth. With multiple staff members coming to and going from the property, ordinary house insurance just isn’t going to cut it.